GST is a tax on the consumption of goods and services. There is only one tax for all the steps involved in the production of goods till their consumption. Earlier, in the name of VAT, there were many different types of taxes, due to which the value of goods increased. With the implementation of GST, the prices of goods will come down. This will reduce the burden on the customers.

Contents

- 1 What is GST?

- 2 Benefits of GST Registration

- 3 Types of GST Registration?

- 4 Who needs GST Registration Number?

- 5 Penalties under GST Act

- 6 FAQs

- 7 Q. What is GST (Goods and Services Tax)?

- 8 Q. What is the concept of a destination based tax on consumption?

- 9 Q. Which of the existing taxes are subsumed under GST?

- 10 Q. What is the status of tobacco products after GST?

- 11 Q. What type of proposal is GST?

- 12 Q. Which authority is to levy and administer GST?

- 13 Q. Is B-2-B transaction subject to GST?

- 14 Q. Need to apply for PAN GST?

- 15 Q. Are all goods and services taxable under GST?

- 16 Q. What is the process of registration for GST?

- 17 Q. Can a person without GST registration claim ITC and collect tax?

What is GST?

GST came into effect from 1st July, 2017 with the implementation of Government of India. This tax has replaced the existing taxes of the Central and State Governments . GST is applicable on different products in the form of 5%, 12%, 18% and 28%.

GST was passed in the Parliament on 29 March 2017 and became effective in India from 1 July 2017. As per GST norms, GST registration and GST filing will be done by the same who is a supplier of 40 lakhs of goods and 20 lakhs of services.

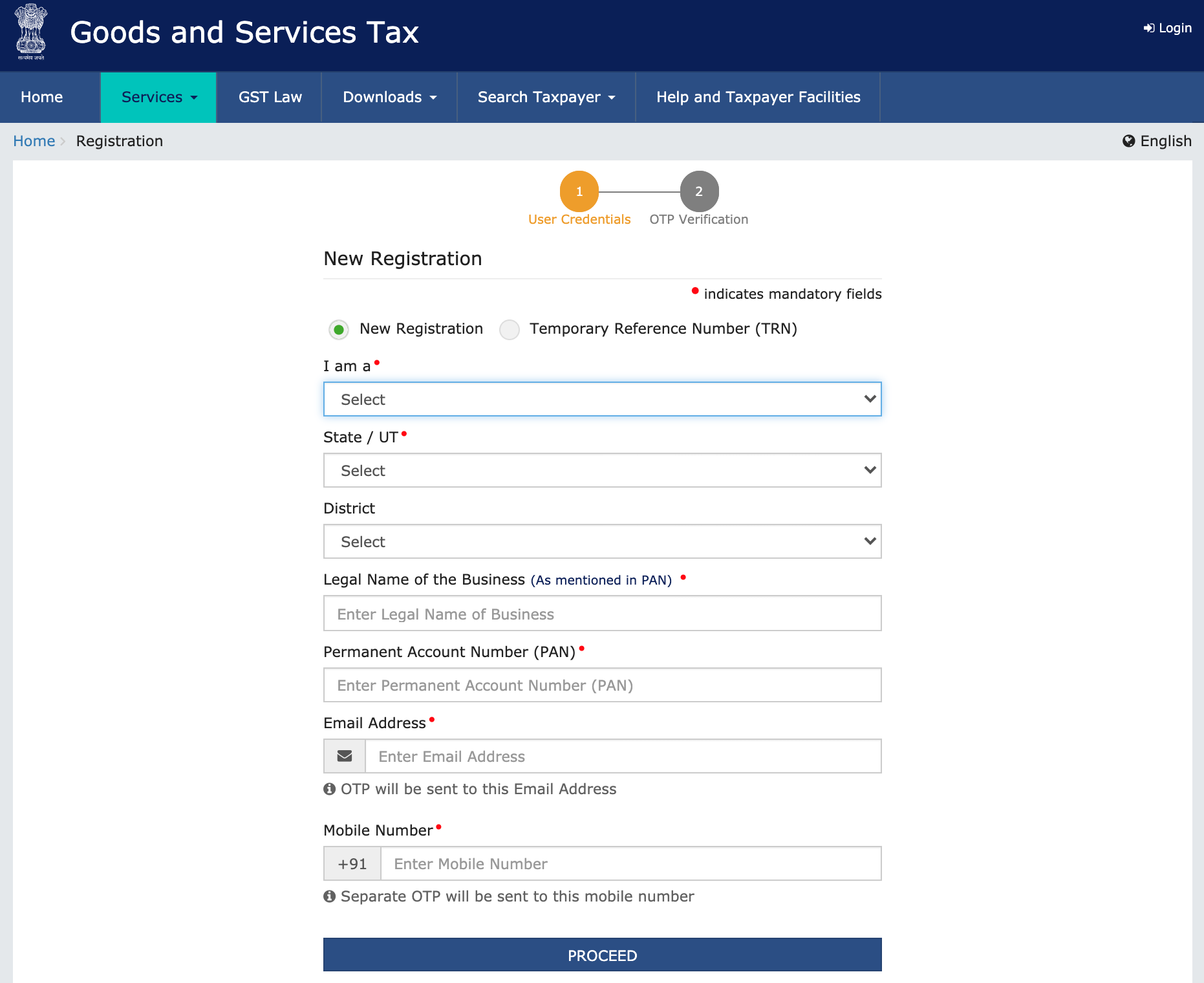

Online GST registration can easily be done online by visiting the GST portal. Click here to register .

When you go to the registration website of GST, then that form will open, keep all the documents asked for in that form and fill the correct information. In this, the documents sought are, PAN card number of the business, PAN card number of the businessman, email address on which one time password will come to verify email, mobile number has to be registered, one time password will also come on that number for verification. From the point of view of the user, filling the form on the GST online portal is very easy.

List of Documents Required for GST Registration

| POSSESSION | PRIVATE LIMITED | PARTNERSHIP / LLP |

|---|---|---|

| owner’s pan card | company pan card | PAN card of participation |

| owner’s aadhar card | basis of all directors | Partners Basis |

| bank details | bank details | bank details |

| address proof | address proof | address proof |

| MOA, AOA and Incorporation | Partnership Deed / LLP Certificate |

Benefits of GST Registration

1. Businessmen can legally collect tax from their customers and pass on the tax benefits to the suppliers.

2. Business becomes 100% Goods and Services Tax compliant. Which brings in cost.

3. The trader can claim the input tax credit which he has paid on the purchase and improve his profits.

4. GST certificate documents can be used as a verify document for opening current account or business account.

5. If the businessman has taken GSTN then he can easily apply for various state and central government tenders.

6. To grow his business, the businessman can expand his business through various channels like online, import-export.

7. For payment, payment gateway or mobile payment can also be used by using GST number.

Types of GST Registration?

A. Registration under Composition Scheme:

This composition scheme is for those small taxpayers who have low business profits. Under this scheme, the eligible taxpayer pays some part of his annual income as tax. For example, small businesses such as restaurants, small retailers and trade on handcarts, etc. are included. for its benefit

- Quarterly return submission, no hassle of every month.

- Deposit work, which will show profit.

- Easier to do accounting and record keeping under GST norms.

The eligibility criteria to register under GST Composition Scheme is:

- Must be a registered taxpayer.

- The annual turnover should be at least Rs 1 crore.

- Manufacturers of goods, dealers, and restaurants (not serving liquor) can opt for this plan.

B. REGISTERED AS QUALIFIED PERSON:

A businessman who produces his goods in many forms and operates in many states can register himself for that one state to whom he wants to pay for his goods and services.

Suppose ‘A’ has a business of person providing services in different states, then he can register for the tax of the particular state corresponding to him.

Who needs GST Registration Number?

- Whose turnover is more than 20 lakh rupees per annum, while for the northeastern states it is 10 lakh rupees.

- The business of a businessman is operating in more than one state.

- If the business of the businessman is already registered under VAT, Excise law, Service tax laws.

- If the businessman sells his products online (like selling on Amazon and Flipkart)

- If the business is providing services and goods outside India.

Penalties under GST Act

- 100% tax or Rs.10,000 if the business of the businessman is as per GST norms and he has not registered for GST. One of the two which will be higher.

- For non-delivery of GST invoice: 100% tax or Rs.10,000. One of the two which will be higher.

- For submission of wrong challan: Rs 25,000

- For non-filing of GST tax return: Rs.20 per day and Rs.50 per day for regular return.

- 100% tax or Rs.10,000 for giving wrong information in composition scheme. One of the two which will be higher.

FAQs

Q. What is GST (Goods and Services Tax)?

A. The name GST (Goods and Services Tax) defines the tax levied on goods and services.

Q. What is the concept of a destination based tax on consumption?

A. Tax will be levied by the tax authority under the GST law which has jurisdiction from production to consumption.

Q. Which of the existing taxes are subsumed under GST?

A. Central Excise Duty

- Excise Duty (Medicinal and Toilet Preparation)

- Additional Duty of Excise (On Special Goods)

- Additional Duty of Excise (Textiles and Textile Products)

- Customs

- service tax

state VAT

- central sales tax

- luxury tax

- Entry Tax (All Types)

- Entertainment and entertainment tax (except when levied by local bodies)

- tax on advertisements

- tax purchase

- Taxes on lotteries, betting and gambling

Q. What is the status of tobacco products after GST?

A. Tobacco and tobacco products are subject to GST.

Q. What type of proposal is GST?

A. GST is adjusted in three different types CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), IGST (Integrated Goods and Services Tax).

A. The Center will levy and administer CGST and IGST, while the respective States/UTs will levy and administer SGST.

Q. Is B-2-B transaction subject to GST?

A. Yes, B2B transactions are subject to GST.

Q. Need to apply for PAN GST?

A. Yes, PAN card is required to apply for GST.

Q. Are all goods and services taxable under GST?

A. All goods and services are eligible for GST except alcohol, petroleum crude, high speed diesel, natural gas and aviation turbine fuel.

Q. What is the process of registration for GST?

A. GST registration can be done in three easy steps:

- application draft

- ARN Number

- Registered GST Number

Q. Can a person without GST registration claim ITC and collect tax?

A. No, tax cannot be deposited without GST registration.